Efficient financial management in project management is a critical component for businesses that aspire to keep their projects within the confines of their allocated budgets while simultaneously achieving their set objectives. This involves a comprehensive approach that includes the adoption of strategic budgeting practices, meticulous cost management, and the judicious allocation of resources. By implementing these techniques, organizations can not only maintain their competitive edge in the market but also ensure the successful execution of projects that align with their financial goals and expectations.

This guide explores the importance of financial management in project management, highlighting common challenges and outlining key steps for effective budgeting. By understanding these elements, businesses can better navigate financial complexities, leading to more successful projects.

Why Is Project Financial Management Important?

Project financials help businesses track, control, and optimize project costs, enabling them to deliver value while remaining within budget. Effective management of project financials ensures that teams can allocate resources wisely, anticipate expenses, and reduce the risk of overspending. Financial management in projects also improves transparency, allowing stakeholders to understand the project’s financial health and make informed decisions.

A sound approach to managing project finances also supports long-term planning and forecasting, helping businesses prepare for future challenges. In industries with high project variability, such as agency work, maintaining a well-structured financial management system is essential for staying agile and profitable.

Common Challenges With Managing Project Financials

Navigating project financials can be complex, especially when balancing budgets, costs, cash flow, and resources. For organizations like agencies, where client expectations and project scopes can vary significantly, effective financial management is crucial. Explore best practices tailored for project management for agencies to tackle these challenges successfully. Here are some of the primary challenges:

Budgeting and Cost Estimation

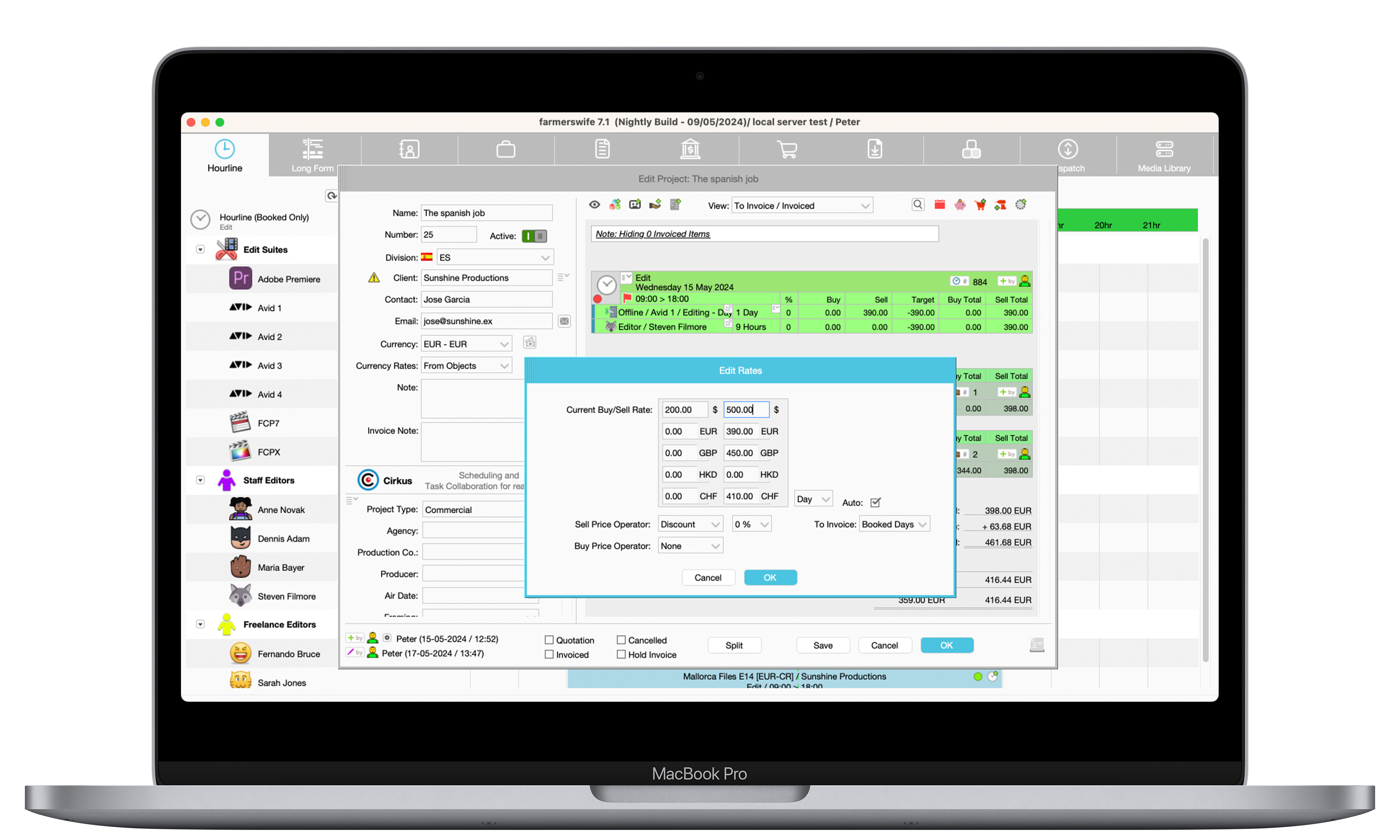

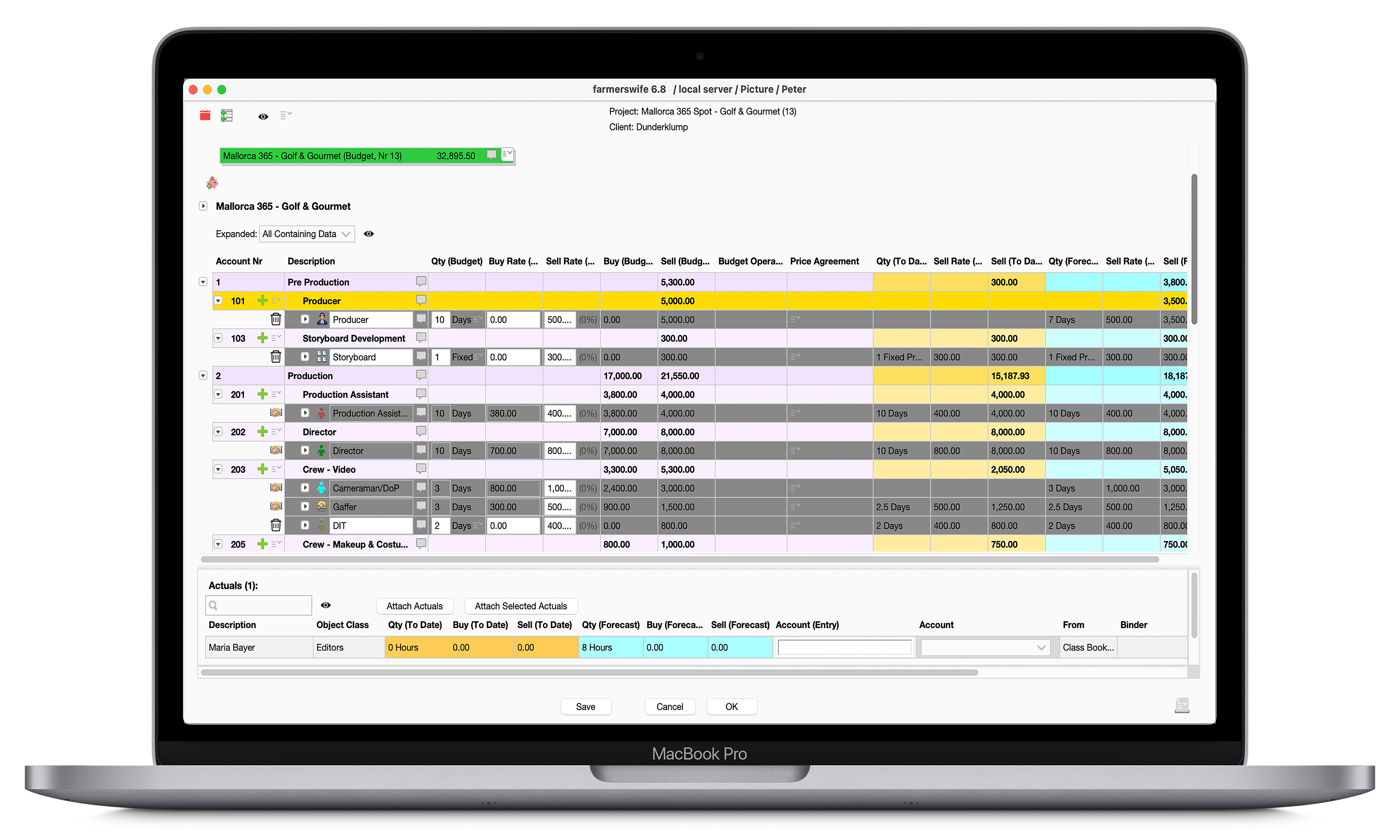

Accurate budgeting and cost estimation are foundational steps in project financial management. Misjudging costs can result in budget overruns, delays, and resource shortages. To prevent these issues, it's crucial to thoroughly assess project requirements and account for all potential expenses. Utilizing tools like farmerswife's budgeting solutions can enhance this process by providing detailed insights and projections, helping to anticipate costs and avoid unexpected financial surprises.

Tracking and Controlling Costs

Keeping costs under control throughout the project lifecycle can be challenging. Unplanned expenses, resource price fluctuations, and scope changes can disrupt the financial plan. Understanding what is financial projection is essential here, as it enables project managers to anticipate potential financial changes and prepare accordingly. Tracking and controlling costs is critical to prevent these issues from impacting the project’s financial performance.

Cash Flow Management

Cash flow is the lifeblood of any project, the invisible force that keeps the wheels of progress turning. Mastering the art of cash flow management is like wielding a magic wand that ensures funds appear precisely when needed, warding off delays and keeping the project on a seamless path to success. On the flip side, poor cash flow management can be a treacherous pitfall, leading to financial turmoil, especially in sprawling, multi-phase projects where every dollar counts.

Financial Reporting and Analysis

Regular financial reporting and analysis offer essential insights into a project's financial status, aiding in trend identification and necessary adjustments. Without precise reporting, tracking progress, evaluating ROI, and aligning with financial objectives becomes difficult. farmerswife allows you to effortlessly produce comprehensive reports on budget status, resource distribution, and spending patterns.

Resource Allocation

Allocating resources effectively across multiple projects or phases requires careful planning and tracking. Misallocation can lead to wasted resources, increased costs, and delays, all of which impact the project’s financial outcomes. Financial management tools can support resource allocation by aligning financial goals with operational needs.

4 Key Steps to Effective Project Budgeting

Setting a project budget is a critical part of project financial management. Here are the steps in effective financial planning to develop and maintain a budget that keeps projects on track:

1. Define the Project Scope

Establishing the project scope provides a clear comprehension of the objectives, deliverables, and requirements, creating a strong basis for precise budgeting within the framework of project financial management. A clearly defined scope is crucial in project financial management as it aids in avoiding scope creep, which can result in unexpected costs and resource challenges. By integrating project financial management principles, teams can ensure that financial resources are allocated efficiently, and potential financial risks are mitigated, thereby maintaining the project's financial health and stability.

2. Estimate Costs

Accurate cost estimation is the backbone of managing *project financials* effectively, setting the stage for a successful budget that stays on target. To avoid surprises, it’s essential to factor in every possible expense—from labor and materials to overhead and contingency funds. By consulting with industry experts and analyzing historical project data, you can craft a more realistic estimate that covers all potential costs, giving your project the financial clarity it needs to thrive.

3. Develop the Budget

Once costs are estimated, develop a comprehensive project budget that allocates funds to each phase, resource, and expense category. Ensure that the budget is flexible enough to accommodate minor changes, but rigorous enough to prevent overspending. . Leveraging production management software can greatly streamline this process, providing real-time insights that enable more precise allocation of resources and expenses. These tools not only simplify tracking and adjusting the budget as needed but also offer a clearer view of how funds are utilized, helping ensure that every dollar spent aligns with project goals and financial targets.

4. Monitor and Control the Budget

Regularly monitoring spending and comparing it against the budget is essential to maintaining control over project financials. By closely tracking expenses, you can quickly spot any discrepancies and address them immediately, preventing small issues from escalating into costly problems. Implementing tracking mechanisms—such as automated alerts for overspending or variances—and conducting periodic financial reviews provide valuable insights into spending patterns and emerging trends. These reviews not only help adjust the budget as needed but also allow for proactive decision-making. By adopting these practices, you can keep project finances on track and avoid unexpected budget overruns.

Conclusion

Effective project financial management is essential to deliver projects within budget and in sync with broader business objectives. This involves a balanced approach to accurate budgeting, rigorous cost control, and efficient resource allocation—all while remaining adaptable to changing demands. Strategic planning and ongoing monitoring are crucial to staying on track, and tools like farmerswife’s project financial management solutions make it easier to streamline these efforts. By following best practices and leveraging these advanced tools, businesses can enhance project performance, optimize spending, and maintain strong financial health even in a volatile marketplace.

Ready to see the difference? Check it out for yourself and discover how farmerswife can elevate your project financials to new heights.

FAQs

1. What role does project financial management software play in cost management?

Project financial management software, like Farmerswife, simplifies cost management by offering budgeting tools, and real-time reporting. It enables project managers to track budgets, allocate resources effectively, and anticipate financial needs, ensuring projects stay on track financially.

2. Why is project financial management so crucial for successful project delivery?

Project financial management ensures that projects not only stay within budget but also align with financial goals and utilize resources efficiently. It supports cost control, transparency, and informed decision-making, helping businesses avoid financial risks and optimize outcomes.

3. How can regular financial reporting help in managing project costs?

Regular financial reporting provides critical insights into the project’s financial status, helping teams identify spending patterns, track budget status, and make timely adjustments. This visibility ensures that cost management remains proactive rather than reactive.

4. Why is proactive risk management important in cost control?

Proactive risk management helps identify potential financial risks early, allowing teams to develop mitigation strategies before issues arise. This approach prevents budget overruns, minimizes unexpected costs, and supports a smoother project execution.

5. What are the main benefits of effective cost management?

Effective cost management ensures project success, enhances financial stability, and boosts profitability. By controlling costs, organizations can allocate resources more efficiently and improve overall financial performance.